ETH Price Prediction: Technical Analysis and Market Outlook Through 2040

#ETH

- Technical indicators suggest ETH is testing crucial support levels with potential for rebound above $4,000

- Fundamental developments including institutional investment and protocol upgrades support long-term growth thesis

- Market sentiment remains divided between short-term technical pressures and strong ecosystem fundamentals

ETH Price Prediction

Ethereum Technical Analysis: Key Indicators Signal Potential Rebound

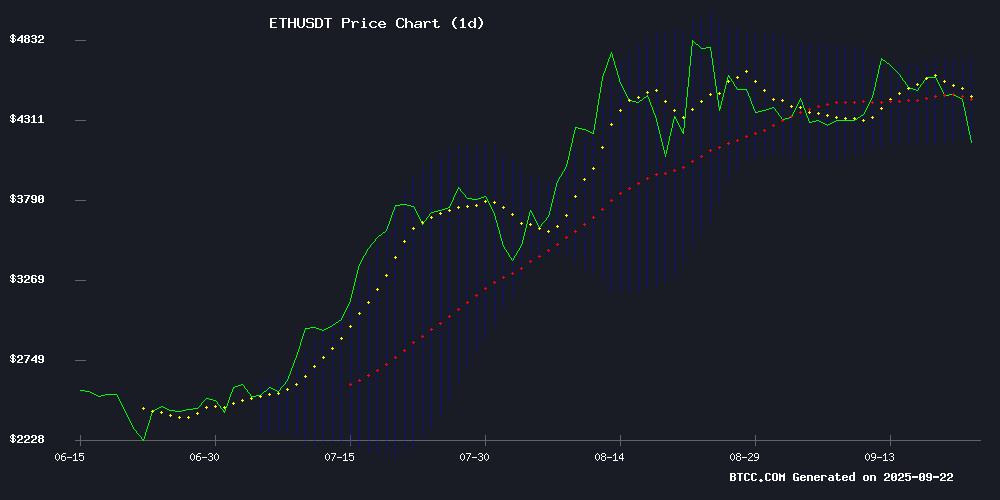

ETH is currently trading at $4,182.51, below its 20-day moving average of $4,441.11, indicating short-term bearish pressure. However, BTCC financial analyst Ava notes that the MACD reading of -73.45 suggests oversold conditions, while the Bollinger Band position NEAR the lower band at $4,157.05 could signal a potential bounce. 'The technical setup shows ETH is testing crucial support levels,' Ava observes. 'A hold above $4,000 could trigger a rebound toward the middle Bollinger Band at $4,441.'

Mixed Sentiment as Ethereum Faces Key Technical Test

Market sentiment remains divided as ethereum approaches critical support levels. BTCC financial analyst Ava highlights that while recent price action shows ETH slipping below $4,200, fundamental developments remain strong. 'The $350M convertible debenture deal for ETHZilla and MetaMask's mUSD stablecoin reaching $65M supply demonstrate robust ecosystem growth,' Ava states. 'However, technical factors currently dominate short-term price action, with the $4,000 level serving as a crucial battleground for bulls and bears.'

Factors Influencing ETH's Price

Why Is Ethereum Down Today, September 22, 2025?

Ethereum's price slid below $4,200 today, extending a broader crypto market downturn. The failure to hold key support levels amplified selling pressure as investor sentiment turned cautious. Recent rallies appear to have exhausted buying momentum, leaving ETH vulnerable to pullbacks.

The $4,500-$4,600 resistance zone continues to cap upside attempts. Without fresh catalysts, Ethereum struggles to sustain breaks above this barrier. Traders now watch the $4,180-$4,200 area as critical short-term support—a breach could accelerate declines toward the psychologically important $4,000 level.

Market dynamics suggest consolidation ahead. Holding above $4,200 may allow another test of overhead resistance, but the absence of strong institutional inflows or protocol developments limits upside potential for now.

ETHZilla Corporation Secures $350M Convertible Debenture Deal to Bolster Ethereum Growth

ETHZilla Corporation (Nasdaq: ETHZ) has announced a $350 million convertible debenture agreement with an existing institutional investor, signaling strong confidence in its DeFi and Ethereum-focused strategy. The deal includes revised terms for $156.5 million in previously issued debentures, further strengthening the company's capital position.

The new debentures carry a 2% annual interest rate, with a conversion price set at $3.05 per share. ETHZilla expects to generate excess interest income from a combined $500 million portfolio of interest-bearing securities. This funding round positions the company to accelerate its Ethereum tokenization initiatives and expand its DeFi footprint.

Despite early trading momentum that pushed ETHZ shares to $2.93, the stock pared gains to $2.5650, reflecting a modest 1.38% increase. The convertible nature of the financing provides future equity upside while immediately enhancing balance sheet resilience.

Ethereum Nears $4,000 as Market Watches for Bullish Continuation or Correction

Ether's surge toward $4,000 has ignited speculation about whether the rally is pausing or reversing. The second-largest cryptocurrency faces a critical technical juncture, with its ability to hold $4,068 support likely determining short-term momentum.

Despite entering a Gaussian Channel that signals waning bullish strength, Ethereum's broader technical structure remains positive. The Relative Strength Index's decline suggests bears are gaining ground, but the market has yet to confirm a sustained downturn.

Ethereum Price Prediction: ETH Shows Bullish Momentum Ahead of Fusaka Upgrade

Ethereum's upcoming Fusaka upgrade, scheduled for December 3, is fueling optimism among traders and analysts. The hard fork aims to address critical pain points—gas fees, scalability, and data availability—with enhancements to blob capacity and gas limits. ETH has stabilized between $4,400 and $4,700, with whale activity surging: $3.8 billion worth of ETH accumulated in 72 hours.

Market watchers see $5,000 as the next psychological resistance level, contingent on successful upgrade implementation and favorable macro conditions. A breakout could propel ETH toward $5,200, marking a new all-time high.

BitMine Immersion Amasses Over 2% of Ethereum Supply in Strategic Accumulation

BitMine Immersion has solidified its position as one of Ethereum's largest institutional holders, acquiring an additional 264,378 ETH to bring its total stake to 2,416,000 tokens. The holding now represents over 2% of Ethereum's circulating supply—a rare concentration for a single entity.

The firm's combined crypto and cash reserves have swelled to $11.4 billion, signaling aggressive treasury expansion. Market observers note such accumulation typically precedes deeper network involvement, whether through staking, governance participation, or infrastructure development.

Ethereum Price Slips Below $4,200 – Can Bulls Defend $4,000?

Ethereum faces intensified selling pressure as its price drops below $4,200, marking a 7% daily decline. The downturn erased $44 billion in market value within a week, casting doubt on the $4,000 support level. Trading volume surged 122% to $41.86 billion, reflecting heightened market activity.

Technical indicators reveal a bearish trend, with ETH breaking below key supports at the 30-day SMA ($4,465) and the 78.6% Fibonacci retracement ($4,378). The RSI at 18.7 signals extreme oversold conditions, while the MACD histogram at -13.94 confirms accelerating downward momentum.

Cascading liquidations totaling $452 million—72% from long positions—exacerbated the sell-off after ETH breached $4,400. The $4,221-$4,000 range, aligning with June's swing low, now serves as critical support.

WSPN Expands WUSD Utility Across Multiple Blockchain Networks

WSPN's WUSD stablecoin has achieved cross-chain interoperability through integration with Stargate Finance, marking a significant advancement in decentralized finance infrastructure. The bridging solution leverages LayerZero's omnichain protocol to enable seamless transfers across Ethereum, Polygon, and Viction networks.

CoinW celebrates its eighth anniversary by introducing a dual-market structure for spot trading while launching WConnect, a new platform feature designed to enhance blockchain ecosystem connectivity. The exchange's upgrades coincide with WUSD's expanded utility across multiple chains.

The strategic deployment positions WUSD as a versatile stablecoin solution in the evolving multi-chain landscape. Future network expansions are planned, offering users greater flexibility in selecting cost-efficient blockchain environments for transactions and DeFi applications.

MetaMask’s mUSD Stablecoin Gains Rapid Traction with $65M Supply Surge

MetaMask's newly launched stablecoin, mUSD, has achieved a circulating supply of $65 million within its first week, signaling strong market adoption. The token is predominantly distributed across Linea (88.2%) and Ethereum (11.8%) networks, leveraging M0's decentralized infrastructure and 1:1 dollar-backed reserves through Stripe's Bridge platform.

The mUSD launch coincides with a broader stablecoin market expansion to $279.8 billion, dominated by Tether's $172.3 billion USDT. Its seamless integration within the MetaMask wallet ecosystem positions it as a formidable contender in the sector, amplified by recent U.S. regulatory clarity via the GENIUS Act.

MetaMask’s mUSD Stablecoin Surges to $65M Supply in Debut Week

MetaMask's newly launched stablecoin mUSD has rapidly achieved a $65 million circulating supply within its first week, marking a significant milestone since its September 15, 2025 debut. The token's growth trajectory saw a sharp rise from an initial $15 million supply, underscoring strong market demand.

Integration with MetaMask's wallet ecosystem—boasting 30 million monthly active users—provided immediate liquidity and accessibility. Early adoption trends reveal a clear preference for Layer 2 solutions, with 88.2% of mUSD deployed on Linea compared to just 11.8% on Ethereum mainnet.

The stablecoin's regulatory-compliant design under the U.S. GENIUS Act and 1:1 backing by Treasury bills positions it as a formidable player in the payment stablecoin arena. Daily reserve audits and compatibility with MetaMask Card further strengthen its merchant payment utility.

Vitalik Buterin Compares Low-Risk DeFi's Role for Ethereum to Google Search's Dominance

Ethereum co-founder Vitalik Buterin posits that low-risk decentralized finance (DeFi) could anchor Ethereum's ecosystem much like Google Search underpins its parent company. In a recent blog post, Buterin dissected two persistent tensions within Ethereum: revenue-generating applications that sustain the network's economic viability versus those fulfilling Ethereum's original vision of democratized access.

The blockchain pioneer drew a parallel to Google's diverse ecosystem—encompassing hardware, AI, and programming languages—where search advertising generates disproportionate revenue. "Low-risk DeFi practices can provide similar foundational stability," Buterin asserted, emphasizing their potential to deliver global, affordable financial infrastructure while addressing Ethereum's existential mismatches.

Ethereum Price Prediction: $6,000 ETH Still on Track Despite Macro Pressures

Ethereum holds firm at $4,596, defying September's ETF outflows and macroeconomic headwinds. Analysts see a path to $6,000 if key technical levels hold, with on-chain metrics suggesting underlying strength.

The asset is consolidating between $4,200-$4,600—a compression pattern that typically precedes volatile breakouts. A decisive move above resistance could trigger a rally toward $5,000, while failure to hold support risks retracement to $3,600-$3,800.

Institutional interest persists despite recent rotations, with staking participation and stablecoin liquidity providing fundamental support. Meanwhile, presale projects like MAGACOIN FINANCE are gaining attention as potential breakout candidates in this environment of regulatory uncertainty and institutional scrutiny.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and fundamental developments, BTCC financial analyst Ava provides the following Ethereum price projections:

| Year | Conservative Forecast | Moderate Forecast | Bullish Forecast | Key Drivers |

|---|---|---|---|---|

| 2025 | $4,500-$5,000 | $5,500-$6,000 | $6,500-$7,000 | Fusaka Upgrade, Institutional Adoption |

| 2030 | $8,000-$10,000 | $12,000-$15,000 | $18,000-$20,000 | Enterprise Adoption, Scaling Solutions |

| 2035 | $15,000-$20,000 | $25,000-$30,000 | $35,000-$40,000 | Global Digital Economy Integration |

| 2040 | $25,000-$35,000 | $40,000-$50,000 | $60,000-$75,000 | Mature Web3 Ecosystem, Regulatory Clarity |

Ava cautions that these projections assume successful protocol upgrades and continued ecosystem development, with short-term volatility expected around key technical levels.